Retirement Income

Peace of Mind

Balanced Allocation Lifetime Income Rider® SGO® Max

Grow Your Future Income

The optional Balanced Allocation Lifetime Income Rider® (BALIR®) with SGO Max offers a source of retirement income you can't outlive.1 BCA 12 2.0 offers potential growth for your retirement savings with protection from downside market risk. Available for a charge, SGO Max provides three powerful ways to grow future lifetime income:

- An 20% Income Base Bonus immediately increases the Income Base, which is used to determine future lifetime income.2

- 4.5% Annual Roll-up provides guaranteed Income Base growth at a 4.5% compounding annual rate for up to 18 years.3

- BCA 12 2.0 Growth adds 100% of the BCA 12 2.0 Interest Earnings, if any, to the Income Base.4

For more information on the Income Base and Income Base Bonus, please see the Key Terms below.

Planning for Lifetime Income

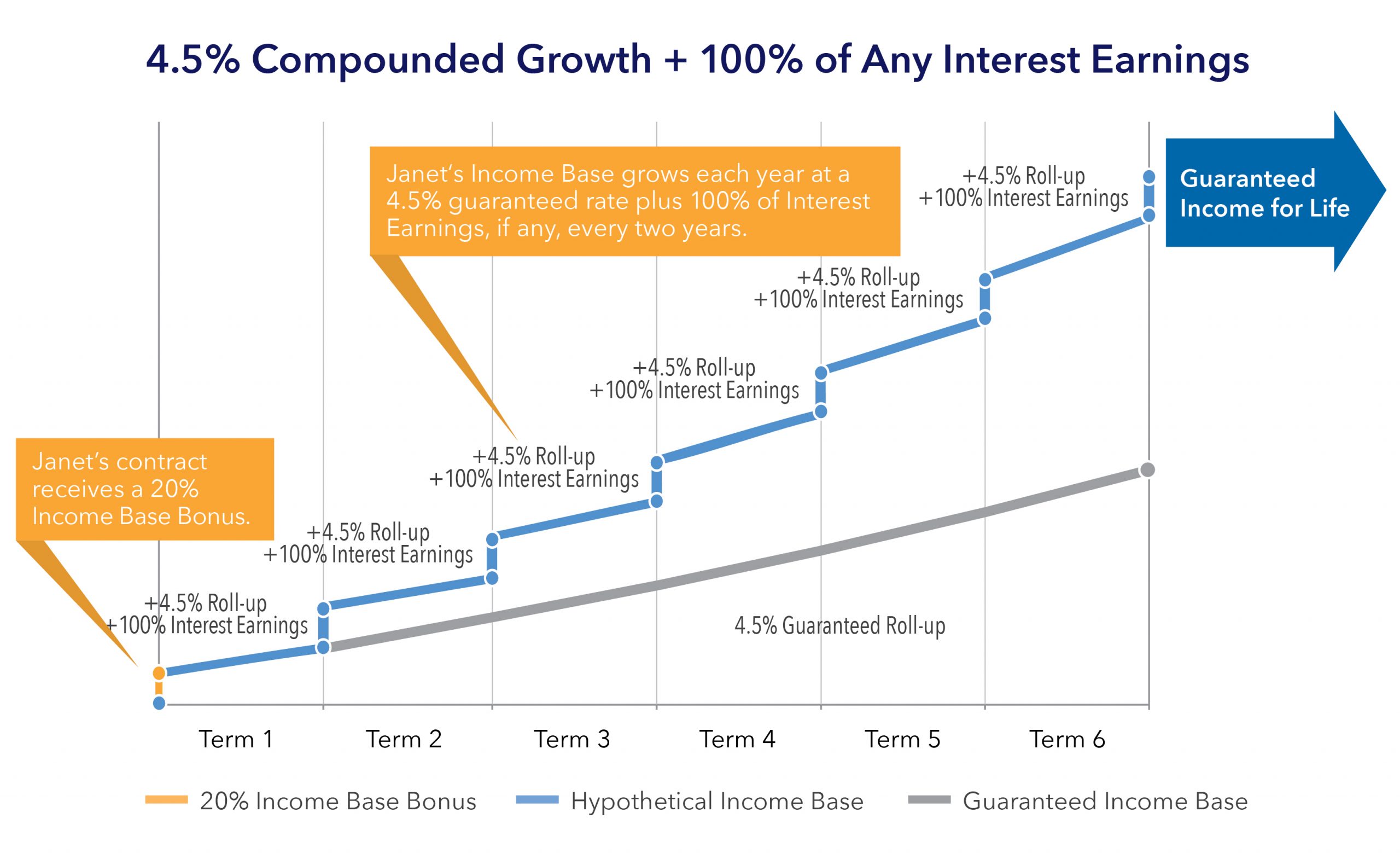

Objective: Janet wants to Maximize her future retirement income.

Solution: Janet allocates a portion of her retirement savings to BCA 12 2.0 with SGO Max. An 20% Income Base Bonus immediately increases the amount used to calculate her lifetime income.5 Her Income Base will grow by a 4.5% “roll-up” annual compounding interest rate plus 100% of her BCA 12 2.0 Interest Earnings, if any, credited to the Income Base at the end of every two-year Strategy Term Period.

Result: After 12 years, Janet begins taking Lifetime Income Withdrawals and benefits from a source of retirement income guaranteed for life.

This is a hypothetical example to show how BCA 12 2.0 and SGO Max can work.

Growth and Lifetime Income

When youʻre ready to begin income, the Lifetime Income Withdrawals are determined by multiplying the greater of the Income Base or Accumulation Value by the Lifetime Income Withdrawal Percentage. The graph below shows how Janetʻs Income Base could grow each year until she begins lifetime income.

For more information about how Lifetime Income Withdrawals are calculated, see the Key Terms. The graph above is for informational purposes only and intended to demonstrate how the Income Base can grow. It is hypothetical and does not demonstrate actual performance of any BCA 12 2.0 or SGO Max contract or index. This does not demonstrate the potential impact of Annual Strategy Charges and withdrawals, which will reduce the Income Base. Please remember that the Income Base is used for calculating Lifetime Income Withdrawals and cannot be withdrawn in a lump sum. The length of each term is two years. For more information about SGO Max, please ask your insurance professional for an illustration.

SGO Max is available with select BCA 2.0 FIAs. Rates and product availability will vary by state and results may be higher or lower. See your insurance professional for detailed information.

Key Terms and Definitions

What is a Fixed Indexed Annuity? – A fixed indexed annuity is a contract issued by an insurance company. In exchange for your premium, the insurance company provides the opportunity for growth based in part on the performance of an underlying index, or group of indices, within a larger strategy while protecting your money from downside market risk. All guarantees are backed by the claims paying ability of the issuing carrier and may be subject to annual charges. Fixed indexed annuities are not stock market investments and do not directly participate in any stock or equity investments or index. It is not possible to invest directly in an index. Other restrictions and limitations may apply. For more information, please contact your insurance professional to see the BCA 12 2.0 product brochure.

Balanced Allocation Lifetime Income Rider Charge (BALIR) – The BALIR is an optional rider that must be elected at contract issue and is available for an annual Income Rider Charge. BALIR offers a choice of two options – SGO Max or Flex Growth. The Annual Rider Charge is calculated at the beginning of every contract year. The charge is deducted in monthly installments from the Accumulation Value and, in some states, the Minimum Guaranteed Contract Value. On the 10th contract anniversary, you may elect to extend Income Base growth up to the 18th contract anniversary. The rider charge may increase by up to 0.20% per year times the number of years extended starting at the beginning of the 11th contract year. The Minimum Interest Credit is not available if the Balanced Allocation Lifetime Income Rider® (BALIR®) is attached to the Contract.

Optional Rider Charges:

- SGO Max – 1.00%

Income Base – The Income Base is used to determine the annual Lifetime Income Withdrawals and annual Income Rider Charge, if applicable. SGO Max offers Income Base growth at a daily rate that is equivalent to 4.5% annual compound interest plus 100% of BCA 2.0 Interest Earnings, if any, minus the Annual Strategy Charge, if applicable. Interest Earnings, if any, are credited to the Income Base until the earlier of Lifetime Income Withdrawals beginning or the 10th contract anniversary (or up to the 18th anniversary if the Income Base growth is extended). If you begin Lifetime Income Withdrawals before the end of a two-year term, interest, if any, will be credited pro rata to the Income Base. The Income Base is not an amount that has a cash value or surrender value that can be paid out partially or in a lump sum. Withdrawals, prior to commencing Lifetime Income Withdrawals, will reduce the Income Base by the same percentage that the Accumulation Value is reduced for the withdrawal. However, the dollar amount of this reduction will not be less than the deduction from the Accumulation Value. After Lifetime Income Withdrawals have commenced, withdrawals up to the Lifetime Income Withdrawal amount will reduce the Income Base by the dollar amount of the withdrawal, while withdrawals in excess of the Lifetime Income Withdrawal amount will reduce the Income Base and future Lifetime Income Withdrawals by the same percentage that the Accumulation Value is reduced for the withdrawal. Withdrawals may also be subject to Withdrawal Charges, Premium Bonus Vesting Adjustments or MVAs, if applicable. For more information, please contact your insurance professional to see the Certificate of Disclosure.

Lifetime Income Withdrawals – Lifetime Income Withdrawals are calculated by multiplying the greater of the Income Base or Accumulation Value by the current Lifetime Income Withdrawal Percentage when Lifetime Income Withdrawals begin. The Lifetime Income Withdrawal Percentage depends on the income option elected and is determined by the “Age” Lifetime Income Withdrawals begin. “Age” means your attained age for Single Life or the younger of your attained age or your spouse’s attained age for Joint Life when your spouse is listed as the sole beneficiary or the contract is jointly owned. In general, the longer you wait to take income, the greater the initial Lifetime Income Withdrawal Percentage will be. When you’re ready to begin Lifetime Income Withdrawals, SGO Max and Flex Growth offer the following options:

- Level Income Option offers the highest initial amount.

- Inflation-Indexed Income Option increases the lifetime income annually based on increases in the Consumer Price Return Index, if any. Increases are capped at 10% per year and stop when the Maximum Inflation Adjustment Period has elapsed.

- Earnings-Indexed Income Option may increase the lifetime income at the end of every 2-year strategy term based on the rate of interest credited, if any, to the Strategy Options elected.

The Inflation-Indexed Income Option and Earnings-Indexed Income Option offer less initial income than the Level Income Option but may provide more income over your lifetime due to potential increases after beginning Lifetime Income Withdrawals. Lifetime Income Withdrawals will continue even if they ultimately reduce the Accumulation Value to zero. Withdrawals in excess of the Lifetime Income Withdrawal may be subject to a Withdrawal Charge, MVA and Premium Bonus Vesting Adjustment and will reduce future Lifetime Income Withdrawals. Withdrawals in some instances could terminate the rider. For more information, please contact your insurance professional to see the Certificate of Disclosure and ask your insurance professional. Withdrawals and surrender may be subject to federal and state income tax and, except under certain circumstances, will be subject to an IRS penalty if taken prior to age 59½.