Finding Value in U.S. Markets

Shiller Barclays CAPE® Allocator 6 Index

An Index Designed by Professor Robert J. Shiller and Barclay

Robert J. Shiller is Professor of Economics and Finance at Yale University, the best-selling author of Irrational Exuberance and co-developer of the CAPE® Ratio.

Barclays is a global investment and retail bank with expertise in investment banking and wealth management.

A New Approach to Proven Investment Practices

The Shiller Barclays CAPE® Allocator 6 Index is a rules-based equity index. A rules-based approach removes emotions, decisions and the need to time the market. The Index applies well-established principles for asset selection and allocation with a goal of providing positive long-term returns.

Each month, a defined set of rules is used to allocate to four market sectors of the U.S. economy. The Index has the ability to allocate a portion to bonds and a portion to the Shiller Barclays methodology based on the demonstrated stability of the equity market to help reduce potential risk and increase potential long-term returns. Two core principles are applied for sector selection and allocation:

Value Investing

- Value investing is a well-known and recognized investment style dating back to the 1930s. Value investors actively seek to buy assets when the price is low and sell when the price is high.

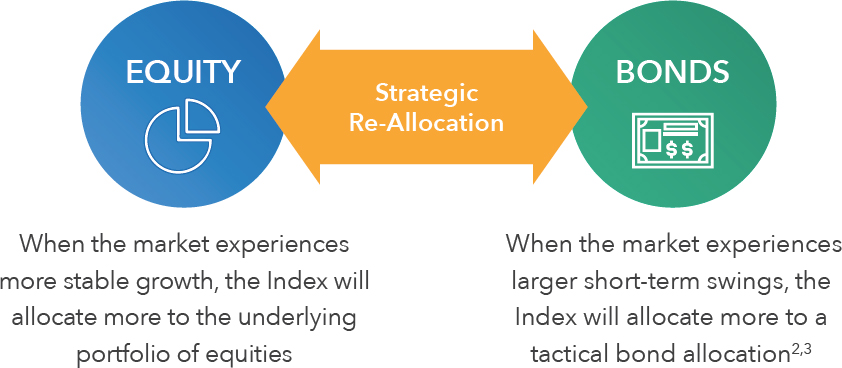

Strategic Re-Allocation

- Rapid changes in the market can be a sign of increased overall risk. When the market is moving rapidly — up or down — there is a greater chance of short-term loss. Strategic re-allocations reduce exposure to equities when the market is unstable.

Key Terms and Resources

CAPE® RATIO – A statistical tool used to identify potential values, the CAPE® Ratio compares the current price to the average earnings over 10 years, adjusted for inflation.

MARKET SECTORS – Types of companies grouped based on the goods or services they produce, such as Health Care or Energy.

MOMENTUM – An indicator of a positive or negative trend in an asset’s price movement over time. Momentum is calculated by comparing the market sector’s current price to the price of the sector 12 months prior.

RELATIVE CAPE® INDICATOR – Measures the current CAPE® ratio compared to its rolling 20-year average. The Relative CAPE® Indicator helps the Index avoid repeatedly selecting sectors with low ratios and exclude sectors with high ratios without considering inherent, long-term differences that cause some sectors to consistently trade at higher or lower classic CAPE® ratios than others over time.

Market Sector Selection Based on Principles for Identifying Value

A monthly sector selection seeks to identify potentially undervalued market sectors. The 11 market sectors of the U.S. economy are evaluated to identify the five that appear to be most undervalued. An additional screen then eliminates one market sector with the least price momentum over the prior 12 months. Equal allocations are made in the remaining four sectors.

The 11 market sectors represented in the Shiller Barclays CAPE® Allocator 6 Index are: Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrial, Materials, Real Estate, Technology, Communications Services and Utilities.1

Monthly Re-Allocation Process

Strategic Re-Allocation Helps Provide Smoother Returns

Rapid movement in the market, or volatility, can create greater potential risk to long-term returns. The Index attempts to reduce the impact of short-term volatility in the equity market sectors through re-allocations between the selected equity sectors and US Treasury bonds.

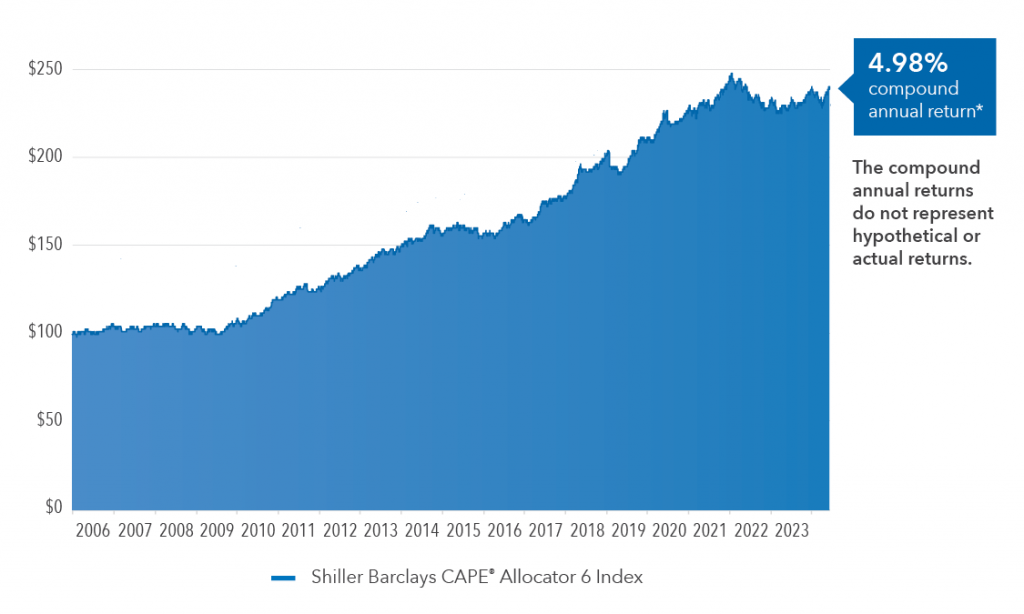

An Opportunity for Positive Long-Term Return

Well-established principles of identifying value and risk control have historically provided positive returns that outpace the broader market. The graph below illustrates actual and back-tested performance of the Index. The Index would have applied value investing and strategic re-allocation methodologies to provide a 4.98% compound annual return.

Shiller Barclays CAPE® Allocator 6 Index

*Hypothetical Assumptions: $100 invested in the Shiller Barclays CAPE® Allocator 6 Index from 12/31/05 to 12/31/23. The Shiller Barclays CAPE® Allocator 6 Index was established on 12/2/2020. Performance shown before this date for the Shiller Barclays CAPE® Allocator 6 Index is back-tested by applying the index strategy, which was designed with the benefit of hindsight, to historical financial data. Back-tested performance is hypothetical and has been provided for informational purposes only. Past performance is not indicative of nor does it guarantee future performance or results. The foregoing performance information does not include any relevant costs, participation rates and charges associated with the BCA suite of FIA or any other financial product linked to the Shiller Barclays CAPE® Allocator 6 Index. For more information on the BCA suite of FIAs and performance with the Shiller Barclays CAPE® Allocator 6 Index, contact your insurance professional.

Contact your Insurance Professional today for more information on the BCA suite of fixed indexed annuities from Athene

Additional details on this web page can be found at Indices.Barclays/ShillerAllocator